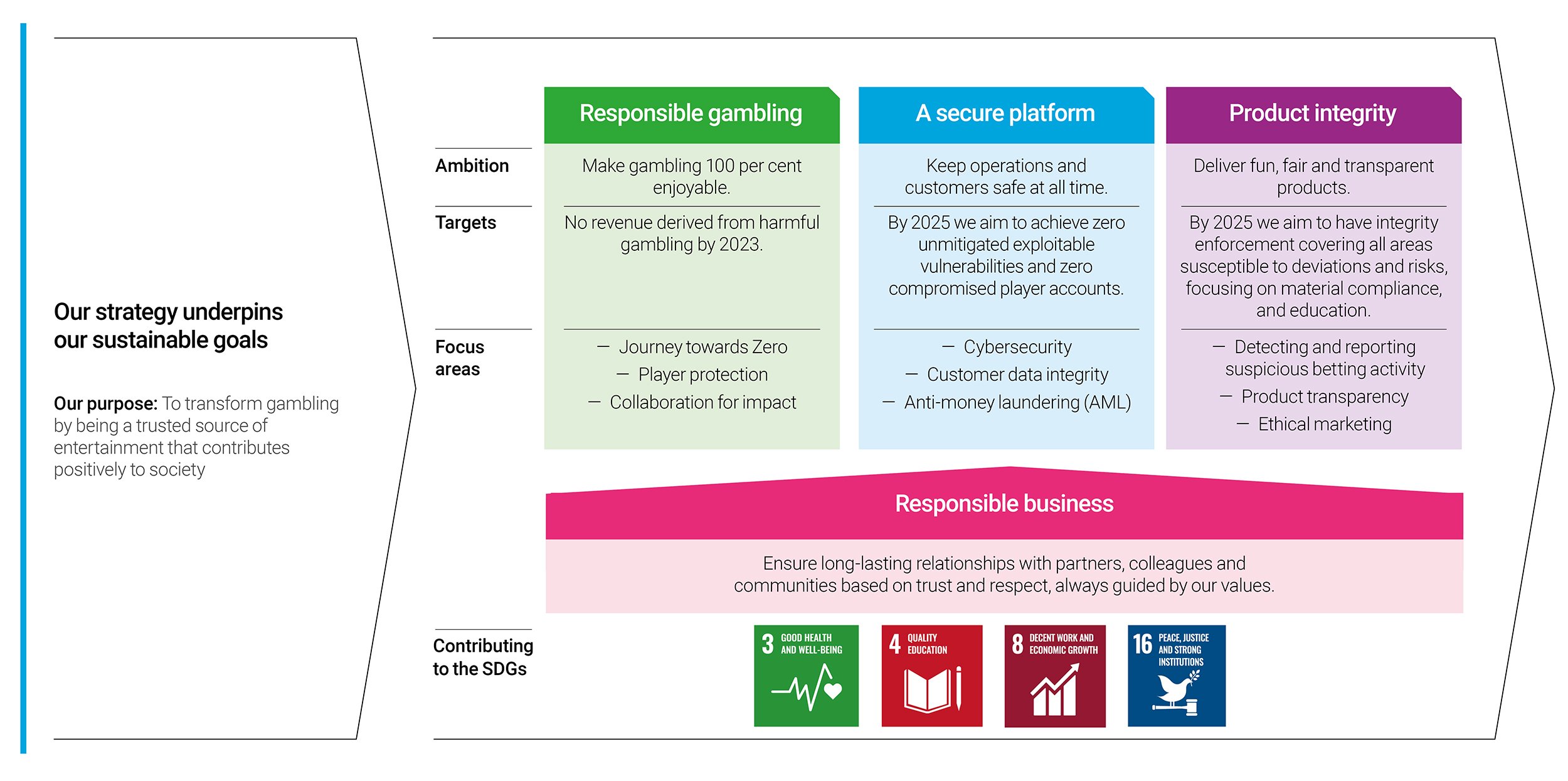

Our sustainability strategy

In 2022, we renewed our sustainability framework. The three pillars and foundation are now describing a set of risks and opportunities that, managed well, support us in achieving commercial success in our markets. Our foundation of governance supports our focus on responsible gambling, product integrity, and a secure platform. Through this approach we can navigate a landscape with increasing pressures from customers, regulator and stakeholders

Our priorities

The three pillars and foundation describe a set of risks and opportunities that, managed well, support us in achieving commercial success in our markets. We want gambling at its best: 100 per cent enjoyable, keeping customers safe at all times and with fun, fair and transparent products.

We have a clear ambition on responsible gambling: to earn no revenue from harmful gambling by the end of 2023. Within the strategy, we aim to have integrity enforcement covering all areas susceptible to deviations and risks, focusing on material compliance, and education is vital to our efforts to deepen trust. Our additional sustainability ambitions relate to a safe and secure platform for players through mitigation and security for player accounts.

We guide our work through a responsible business foundation, with performance with our people at the centre, and aiming to reduce our climate impact. The combined effect provides long-term commercial resilience, reduced volatility, and the ability to attract and retain the best people.